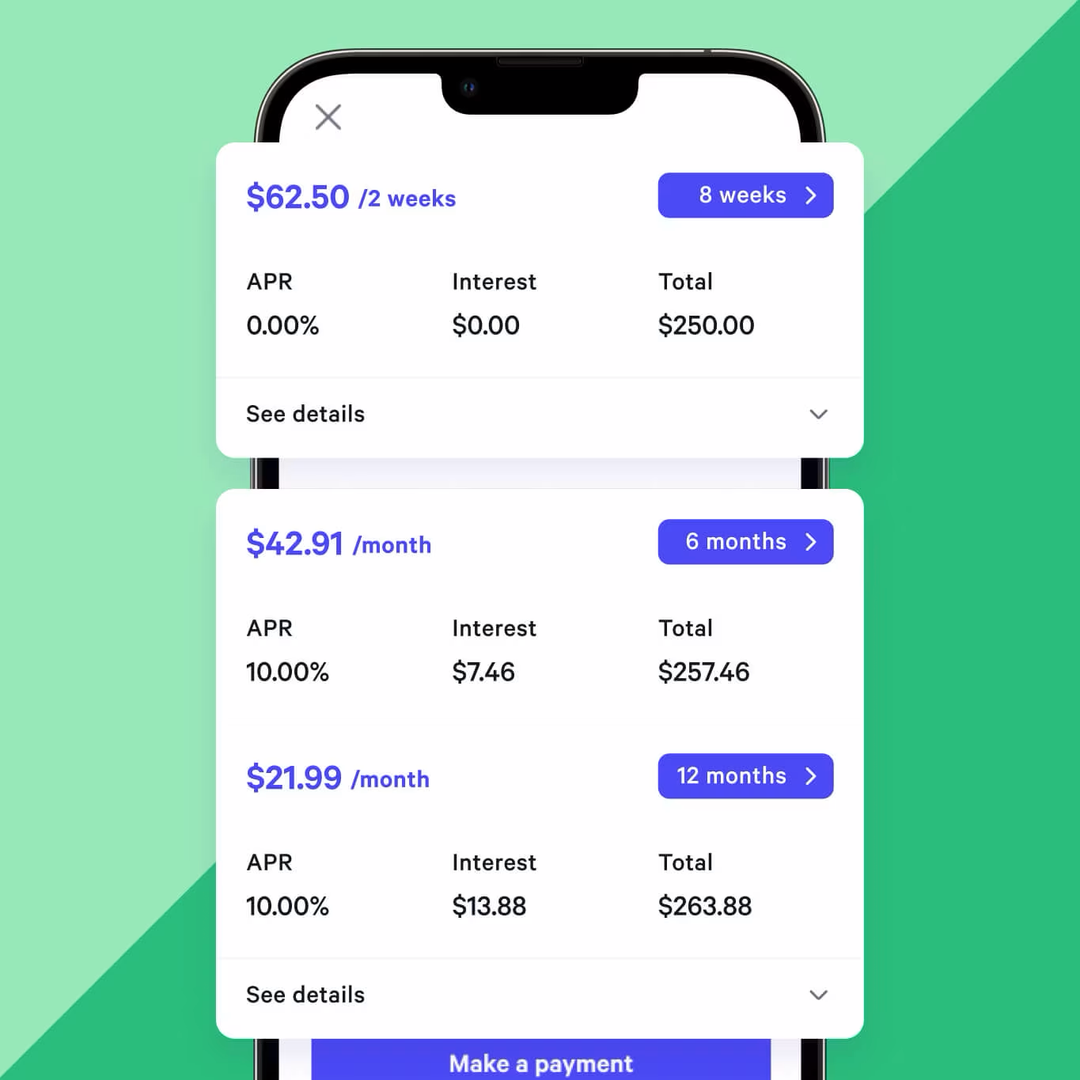

Monthly Payments

Choose monthly installments. Perfect for bigger ticket items.

- No hidden fees—ever

- What you see is what you pay

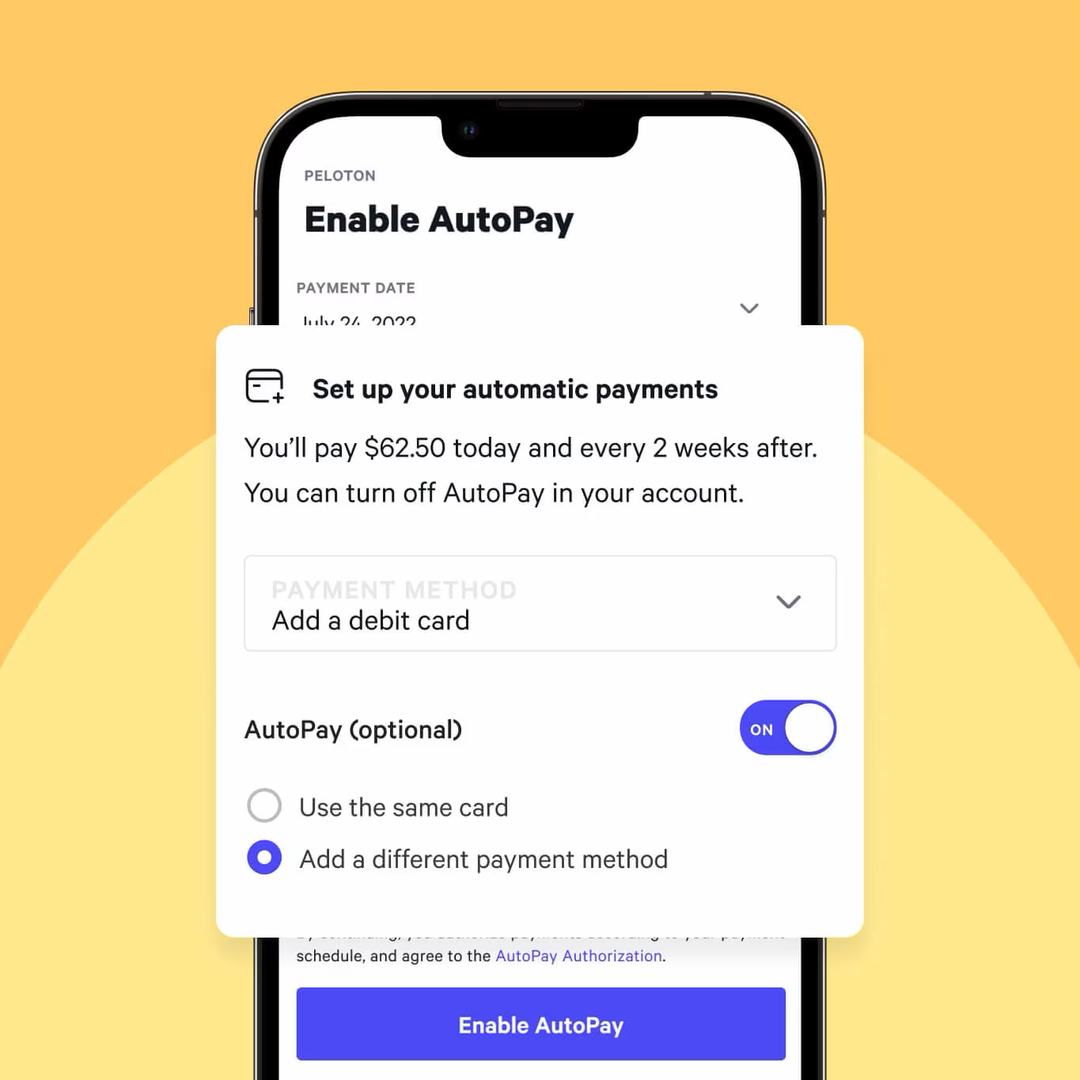

- Set up easy, automatic payments

Pay over time for the things you love

No credit impact

Checking your eligibility is quick and easy—and it won’t ding your credit.

Get set up in minutes

Setting up Autopay is easy, so the only thing you’ll have to do is enjoy your purchase.

No hidden fees – ever

That’s why over 1 million shoppers trust Affirm.

Fill your cart

Shop at many of your favourite stores and select Affirm at checkout. Then enter a few details for an instant decision. We do a soft credit check when you apply for any Affirm payment plan. This won’t impact your credit score.

Choose how to pay

Select your payment plan, then confirm your loan. We’ll never charge more than you see up front.

For example: Let’s say you make a purchase of $1,000. Choose to make 4 biweekly, interest-free payments of $250 or pay over 3 ($333/mo), 6 ($166/mo) or 12 ($83/mo) months from 0-32% APR (subject to provincial regulatory limitations). Please see table for more details.

Make your payments

Manage your payments in the Affirm app or online, and set up AutoPay so you don’t miss a payment. But if you do, you’ll never pay any fees.

Use Affirm here—and there

Choose us at checkout

It’s easy to pay over time. Just select Affirm at checkout when shopping at your favourite stores to see your payment options.

Shop online and in-store

Shop at thousands of stores you love—and thousands you haven’t discovered yet—online and in-store at participating retailers.

Download the app

Download the Affirm Canada app so you can manage and track all your purchases in one convenient place.

Questions? We’re here to help

Creating an Affirm account and seeing if you prequalify will not affect your credit score.

Fees - We don’t charge any fees. That means no late fees, no prepayment fees, no annual fees, and no fees to open or close your account.

Interest - Depending on the size of your purchase and where you’re shopping, your payment plan may include interest. You’ll never owe more interest than you agree to on day one—so you always know exactly what you’re getting into.

When you prequalify, you get an estimate of how much you can spend with Affirm. You don’t have to use the full amount, and you’re not on the hook to pay anything back until you actually make a purchase. The final amount you qualify for is subject to eligibility criteria.

PayBright is now Affirm! When you make your first purchase with Affirm, you will create a new account. If you have an existing PayBright loan, you can access your PayBright loan and account information through the PayBright portal.